Are you tired of feeling overwhelmed by tax debt balance and financial burdens? Look no further! In this blog post, we’ll dive into the IRS Fresh Start Program, a game-changer for those seeking relief from their tax obligations.

The IRS Fresh Start Program is a valuable initiative to help taxpayers struggling with back taxes. If you find yourself in a situation where you owe a significant amount of money to the IRS, the Fresh Start Program can provide options to alleviate your financial burden.

Whether you’re an individual or a small business owner, understanding this program is crucial in reclaiming your financial freedom. Join us as we explore the ins and outs of the IRS Fresh Start Program, its eligibility requirements, available options, and tax experts’ tips to make the most of it.

Prepare to conquer your tax troubles and embark on a path toward your financial situation and a brighter future.

What is the IRS Fresh Start Program?

The IRS Fresh Start Program is a lifeline for individuals and businesses drowning in a tax lien. Designed to provide relief from a tax bill and a fresh financial start for qualified taxpayers, this initiative aims to ease the burden of overdue taxes and other tax payments to make it more manageable for taxpayers’ tax liabilities to meet their obligations.

The program primarily targets individuals with outstanding tax liabilities and small business owners struggling to pay taxes. It offers various payment options to settle tax bills or reduce tax liabilities, including installment plan agreements, tax payments, offer in compromise tax attorneys, and request penalty abatement.

Through an extended installment agreement, taxpayers can set a payment option like pay monthly plan, allowing them to gradually pay off their unpaid taxes. Offer in compromise allows settling the tax debt relief for less than the actual amount owed, based on the taxpayer’s financial situation. Penalty abatement helps waive certain penalties, reducing the IRS and overall tax debt relief burden.

Individuals, family members, and businesses can resolve their own money or tax issues and regain control over their tax returns and finances by participating in the IRS Fresh Start Program.

Eligibility Requirements

Before delving into the specifics of the Fresh Start Program, it’s essential to understand the eligibility requirements. To participate in the program, you must meet certain criteria:

- Income Qualifications: Your income must fall within the program’s guidelines. The IRS sets income qualifications to ensure that those who genuinely need assistance receive it.

- Tax Debt Limits: The Fresh Start Program has specific limits on unpaid taxes. If your outstanding tax liability exceeds a certain threshold, you may be eligible for specific relief options under the program.

Understanding these eligibility requirements will help you determine if you qualify for the Fresh Start Program and which relief options you can pursue.

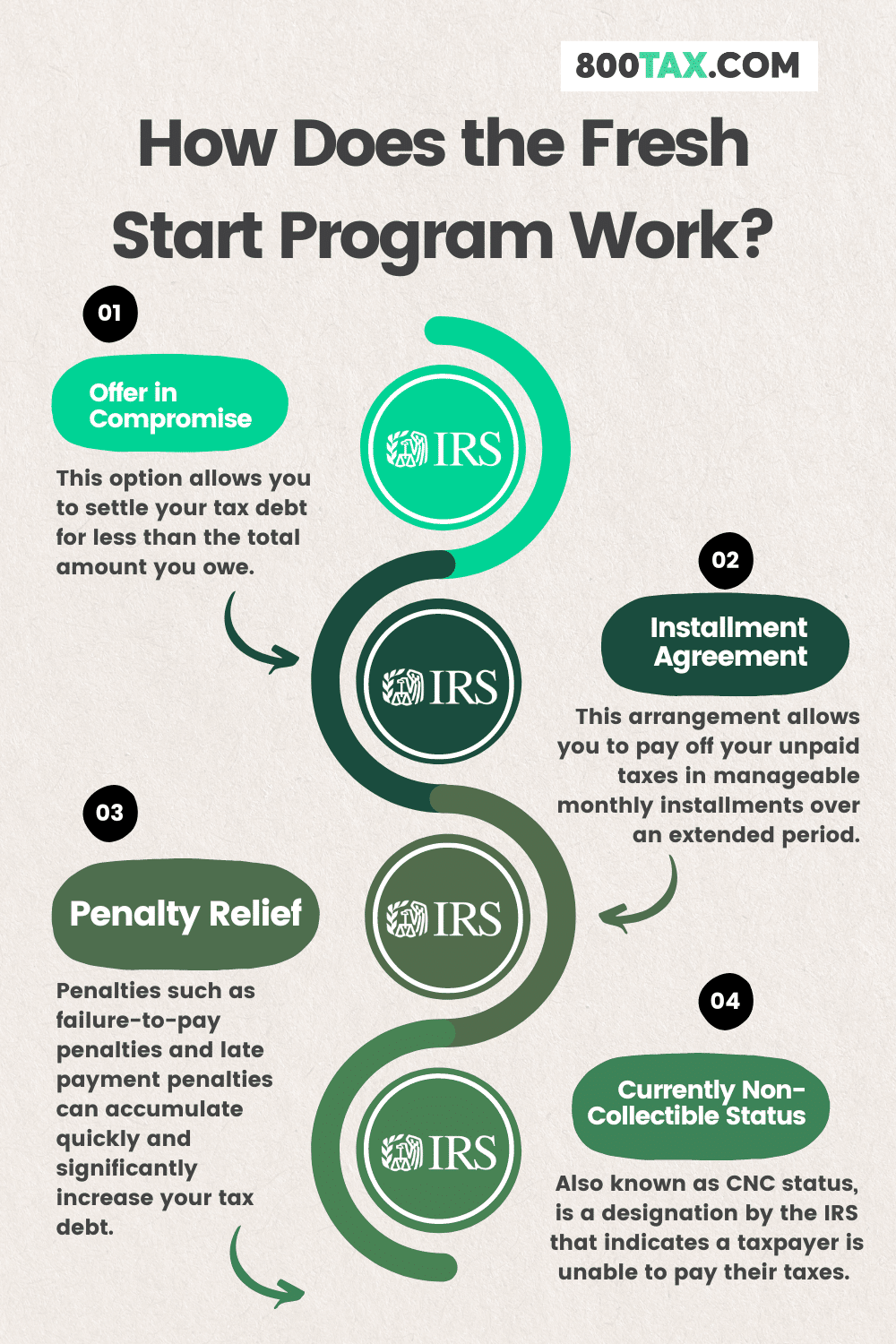

How Does the Fresh Start Program Work?

Taxpayers have access to four main programs designed to provide financial relief:

Offer in Compromise

The Offer in Compromise (OIC) is one of the relief options provided through the Fresh Start Program. This option allows you to settle your tax debt for less than the total amount you owe. It provides a realistic opportunity to resolve your tax obligations and achieve a fresh start.

To qualify for an Offer in Compromise, you must meet specific criteria established by the IRS. This includes demonstrating your inability to pay the full amount owed within a reasonable period. The application process involves submitting detailed financial information and a proposal for settling your unpaid taxes.

Installment Agreement

Another option available under the Fresh Start Program is the Installment Agreement. This arrangement allows you to pay off your unpaid taxes in manageable monthly installments over an extended period. It provides a suitable option if you cannot afford to pay your tax obligation in full immediately.

To qualify for an Installment Agreement, you must demonstrate your ability to make consistent monthly payments. The IRS offers various payment options and terms to accommodate your financial situation. This option helps alleviate the stress of dealing with the entire tax debt burden all at once.

Penalty Relief

Under the Fresh Start Program, certain types of penalties can be eligible for relief. Penalties such as failure-to-pay penalties and late payment penalties can accumulate quickly and significantly increase your tax debt. However, the program provides an avenue for penalty relief, reducing the overall amount you owe.

To request penalty relief, you must submit a penalty abatement request to the IRS. This request should outline the reasons why you believe the penalties should be waived or reduced. Providing supporting documentation strengthens your case for penalty relief.

Currently Non-Collectible Status

Also known as CNC status, is a designation by the IRS that indicates a taxpayer is unable to pay their taxes. While in Currently Non-Collectible Status, the IRS temporarily halts collection activities such as bank levies, wage garnishments, tax liens, and threatening letters.

To qualify for Currently Non-Collectible Status, taxpayers need to meet the IRS Fresh Start Program qualifications. These qualifications may involve providing financial information, demonstrating an inability to pay, and potentially undergoing a review of income and expenses. The IRS may also request the filing of any past due tax returns before placing an account in CNC Status.

Benefits of the IRS Fresh Start Program

The IRS Fresh Start Program offers a range of benefits that can greatly alleviate the stress and financial burden caused by unpaid taxes. Let’s explore some of the key advantages of the program:

1. Reduced Financial Burden:

One of the primary benefits of the Fresh Start Program is the opportunity to reduce your overall tax debt. Options like the Offer in Compromise (OIC) allow taxpayers to settle their debt for less than the original amount owed. This can lead to substantial savings and provide a fresh start.

2. Affordable Payment Plans:

The Fresh Start Program offers flexible installment payment agreements, making it easier for individuals and businesses to establish affordable monthly payments. These agreements help prevent the accumulation of further interest and penalties, allowing taxpayers to stay on track with their required estimated tax payments.

3. Penalty Relief:

Taxpayers may qualify for the waiving of certain financial penalties associated with their tax debt through penalty abatement. This can result in significant savings and enable individuals to focus on paying off the principal amount.

Recognizing the positive outcomes from financial difficulties experienced by some taxpayers, the National Taxpayer Advocate highlights the potential of the “Fresh Start” initiative to offer compromise and aid to more individuals striving to restore their financial stability. Meeting the criteria and providing accurate documentation will increase your chances of successfully participating in the program.

How to Qualify for the IRS Fresh Start Program

Certain qualification criteria must be met to take advantage of IRS Fresh Start Tax Programs. Here are the key factors which eligible taxpayers consider:

- Tax Liability: You must have unpaid federal taxes, penalties, and interest owed to the local IRS office.

- Income: The program considers your income level to determine eligibility. Generally, individuals with limited income or experiencing financial hardship are more likely to qualify.

- Ability to Pay: You must demonstrate that you cannot pay the full tax debt immediately or within a reasonable timeframe.

Tips on how to meet these criteria:

- Assess your tax liability accurately to determine your owed amount.

- Prepare documentation to support your income and financial hardship, such as pay stubs, bank statements, and proof of expenses.

- Contact or visit the IRS website to discuss your situation, provide the necessary documentation and explore available options under the Fresh Start Program.

- Consider consulting with tax professionals or an enrolled agent who can guide you through the qualification process and help you present your case effectively.

Meeting the qualification criteria and following these tips can increase your chances of qualifying for the IRS Fresh Start Program and finding tax returns from your tax burdens.

Applying for the Fresh Start Program

To apply for the program, gather all necessary documentation, such as tax returns, financial statements, and proof of income. The IRS requires detailed information to assess your eligibility for specific relief options. Submitting accurate and complete documentation can expedite the processing of your application.

Common Mistakes to Avoid When Applying

When applying for the IRS Fresh Start Tax Program, avoiding common mistakes hindering your approval is crucial. Here are some pitfalls to steer clear of:

- Providing incomplete or inaccurate information on your application. Incomplete or inaccurate information can lead to delays or rejection of your application, which may hinder the IRS’s ability to assess your eligibility properly.

Tip: Double-check all the details and ensure they are accurate and up-to-date before submitting your application. - Missing deadlines for application submission. Missing deadlines can result in missed opportunities to participate in the IRS Fresh Start Program, as applications submitted after the deadline may not be considered.

Tip: Stay organized and set reminders to submit all required documents and forms within the specified timeframe. - Failing to provide sufficient supporting documentation. Insufficient supporting documentation weakens your case and may make it challenging for the IRS to assess your eligibility accurately.

Tip: Gather all necessary financial documents, such as income statements, living expenses records, and tax filings, to strengthen your application and support your eligibility. - Ignoring correspondence or failing to respond to IRS requests. Neglecting to address IRS inquiries or requests for additional information can lead to delays or denial of your application, as it hampers effective communication and review.

Tip: Stay vigilant and promptly address any inquiries or requests for a collection information statement from the IRS to avoid delays or potential denial of your application.

By being mindful of these common mistakes, understanding their meanings, and following the corresponding tips, you can increase your chances of successfully applying to the IRS Fresh Start Program and enhance your prospects of obtaining the much-needed tax relief due to your tax burdens.

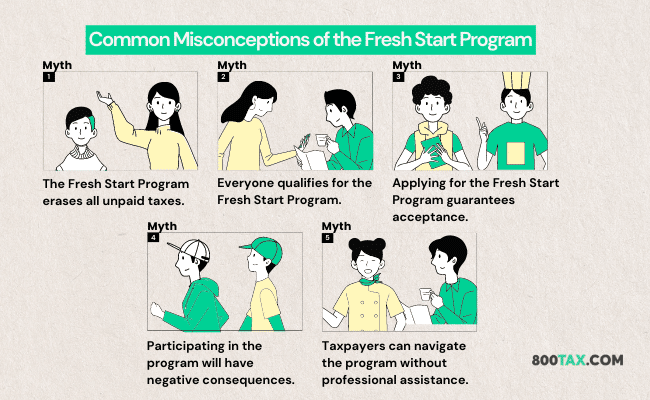

Common Misconceptions of the Fresh Start Program

There are several misconceptions surrounding the Fresh Start Program that can mislead taxpayers. Let’s debunk some of the most common myths:

Myth #1: The Fresh Start Program erases all unpaid taxes.

Reality: The program offers relief options to manage and reduce tax debt but does not eliminate it in all cases.

Myth #2: Everyone qualifies for the Fresh Start Program.

Reality: The program has specific eligibility requirements, and not all taxpayers will qualify for all relief options.

Myth #3: Applying for the Fresh Start Program guarantees acceptance.

Reality: Each relief option has criteria, and approval is not automatic. Meeting the requirements and providing accurate documentation is crucial.

Myth #4: Participating in the program will have negative consequences.

Reality: The Fresh Start Program aims to provide relief and help taxpayers resolve their tax debt. It does not result in additional penalties or adverse effects.

Myth #5: Taxpayers can navigate the program without professional assistance.

Reality: While applying for the Fresh Start Program independently is possible, consulting with a tax professional can help you explore all available options and make informed decisions.

Conclusion

In conclusion, the IRS Fresh Start Program offers a lifeline for individuals and businesses burdened by tax debt. Taxpayers can confidently navigate the application process by understanding the program’s qualification criteria, benefits, and potential pitfalls.

Remember to provide accurate information, meet deadlines, gather necessary documentation, and promptly respond to tax relief company correspondence like IRS Fresh Start Tax Program. Don’t let federal tax liens hold you back.

Take action today and explore the possibilities offered by the IRS Fresh Start Program. Reclaim your financial freedom and pave the way to a brighter, debt-free future.

Get Professional Guidance. Schedule a Free Consultation Today!