Are taxes leaving you overwhelmed as an e-commerce or business owner? Don’t fret! Discover the powerful strategies for effective tax relief in this comprehensive guide.

As an entrepreneur, you understand taxes’ critical role in financial success. However, navigating the complex world of taxation can be a daunting task. From ever-changing regulations dealing with Internal Revenue Service (IRS) to complex compliance requirements, tax problems can seem impossible.

But fear not! You can unlock benefits by implementing the right tax return filing strategies to qualify for programs like tax exemptions.

In this article, we’ll explore the importance of filing for tax relief, tackle your challenges with filing now, and unveil the benefits of adopting business bureau effective filing strategies to file now. Prepare to revolutionize your tax approach and achieve financial peace of mind.

Understanding Tax Relief

Tax and credit relief, or tax refund or credit, is more than just a buzzword; money is a lifeline for companies seeking financial stability and growth. In this section, we will provide you with a definitive overview of tax and credit relief, its significance, and the impact it can have on your business.

Various business bureau strategies and provisions are implemented to help businesses and families pay or reduce tax penalties and alleviate the interest burden they owe. It offers hope amidst the complex world of taxation law, allowing businesses and families to optimize their income and reinvest more money in their core operations.

There are several types of tax relief options available to companies. Common avenues include tax deductions, tax credits, and incentives offered by government bodies. These various tax code options aim to reward and encourage specific activities that contribute to economic growth, innovation, and job creation.

Implementing effective tax relief strategies can profoundly impact taxpayers’ businesses’ income stability and growth. By reducing your tax liability fees, you can free up valuable resources to reinvest in research and development, expansion, marketing, and employee development. This bolsters your bottom line, fuels innovation, improves competitiveness, and paves the way for long-term success.

Key Tax Relief Strategies for E-commerce and Business Owners

Regarding minimizing child tax credit liabilities, e-commerce, and business owners can leverage various strategies, including the Child Tax Credit. This comprehensive guide explores practical approaches to achieve significant child tax credit debt relief and optimize financial positions.

Deductions and Credits Specific to E-commerce Businesses

As an e-commerce business owner, you can use deductions and credits tailored to your industry. This may include deductions for shipping costs, packaging supplies, online advertising expenses, and even certain website development costs.

Stay updated on the specific deductions and credits available for e-commerce businesses to maximize your tax savings, including the potential benefits of the Child Tax Credit.

Tax Planning and Optimization Techniques

Strategic tax planning is key to minimizing the total amount owed tax. Work with tax professionals and stay informed about current tax laws the Internal Revenue Service (IRS) sets each tax year.

This may involve timing earned income and expenses, maximizing retirement contributions, leveraging tax-efficient investments, and exploring deferral options.

A well-executed tax payment plan can result in significant income for your business while also considering the potential advantages of the Child Tax Credit.

Utilizing Business Structures for Tax Advantages

Choosing the right business structure can provide tax advantages. Depending on your circumstances, forming a limited liability company (LLC), S corporation, or C corporation can offer benefits such as pass-through taxation, reduced self-employment taxes, or increased tax flexibility.

Consult with a tax advisor to determine the most suitable structure for your business, considering the potential benefits of the Child Tax Credit.

Exploring Tax Relief Opportunities for Investments and Expenses

Certain eligible investments and expenses qualify for tax returns. Research tax credits and incentives for research and development (R&D), energy-efficient equipment, employee training, or environmental initiatives qualify.

These opportunities can reduce your tax burden or interest payments and support assets growth, innovation, and sustainability, including the potential benefits of the Child Tax Credit.

According to a survey by the National Small Business Association (NSBA), small businesses in the United States spend a lot of significant time on paying federal taxes, including tax planning, financing preparation, payments, and compliance. This statistic emphasizes the importance of tax relief measures to alleviate small businesses’ administrative burden.

Navigating Tax Relief During Economic Downturns or Crises

Tax relief measures may be introduced to support families and businesses during challenging economic downturns or crises. Stay informed about any tax breaks, deferrals, or government debt relief programs that can help alleviate financial pressure and provide much-needed money and breathing space for your families and business, including potential expansions of the Child Tax Credit.

Tax Relief Compliance and Reporting

Compliance with tax laws and regulations is vital for businesses seeking tax relief. It ensures transparency, integrity, and trust with tax authorities.

Adhering to tax laws is crucial to maintain a strong foundation for tax relief. Understand the law and meet reporting obligations, such as filing tax returns accurately and on time. Stay organized, file well, track deadlines, file often, and maintain comprehensive income, expenses, invoices, and receipts records.

Accurate tax records and documentation are crucial in substantiating deductions and credits to pay for income you owe or claim income others owe you to pay for. They serve as evidence in case of audits or inquiries. Neglecting proper record-keeping can lead to penalties, interest charges, or legal consequences.

Non-compliance with tax laws can have severe ramifications for businesses, including penalties and reputational damage. Prioritize compliance, pay up, meet reporting requirements, pay, and understand the potential consequences of non-compliance.

Seeking Professional Assistance for Tax Relief

Seeking professional assistance for tax relief, including credit and tax refunds, can be a game-changer for eligible taxpayers and families. Tax professionals bring invaluable expertise and knowledge, ensuring compliance while maximizing available credit and tax return opportunities for eligible families and others, including those provided by the American Rescue Plan.

American Rescue Plan develops personalized strategies based on your business needs, identifying deductions, credits, and incentives that apply to your industry.

By working with tax professionals, you can navigate the complex process, receive accurate tax help advice, and have representation in interactions with tax authorities, including the Internal Revenue Service (IRS).

There are common misconceptions surrounding tax relief services. Contrary to belief, tax professionals cater to businesses of all sizes, and their involvement demonstrates a commitment to compliance rather than raising suspicion. The American Rescue Plan provides peace of mind and expert guidance, maximizing your chances of achieving tax refund benefits.

Choosing the Right Professionals

When selecting a tax professional or agency, consider their services, qualifications, experience, and track record.

- Look for certifications like Certified Public Accountant (CPA) or Enrolled Agent (EA).

- Seek recommendations, review client testimonials, and assess their expertise in tax returns strategies.

- Have excellent communication skills, be responsive to your needs, and offer transparent pricing structures.

Case Studies: Successful Tax Relief Strategies in Action

Real-life case studies offer valuable insights into how businesses successfully implement tax relief strategies.

Case Study 1: Amazon

Amazon is a well-known example of a business implementing successful various income tax return strategies. In 2017, Amazon paid $0 in federal income taxes. This was due to several factors, including the company’s use of tax credits and deductions and its operating at a loss for several years.

Challenges Faced:

- Amazon is a large and complex company with a global reach.

- The company is subject to a variety of tax laws in different countries.

- Amazon has been criticized for its use of tax loopholes and deductions.

Outcomes Achieved:

- Amazon has been able to reduce its tax liability significantly.

- The company has been able to reinvest its profits in growth and expansion.

- Amazon has been able to maintain its competitive advantage.

Insights and Lessons Learned:

- Use tax relief strategies to reduce tax liability.

- It is important to know the different tax laws in different countries.

- Consider tax loopholes and deductions’ potential risks and benefits.

Case Study 2: Apple

Apple is another well-known example of a business implementing successful tax relief strategies. In 2018, Apple paid $38 billion in taxes to make payments benefit the United States government. However, the company also had $252 billion in profits in offshore tax havens.

Challenges Faced:

- Apple is a large and complex company with a global reach.

- The company is subject to a variety of tax laws in different countries.

- Apple has been criticized for its use of offshore tax havens.

Outcomes Achieved:

- Apple has been able to resolve its tax debt significantly.

- The company has been able to reinvest its profits in growth and expansion.

- Apple has been able to maintain its competitive advantage.

Insights and Lessons Learned:

- Use tax relief strategies to reduce their tax liability.

- It is important to know the different tax laws in different countries.

- Consider the potential risks and benefits of offshore tax havens.

These are just two successful tax credit relief strategies businesses have implemented. Many other businesses have used tax credit relief strategies to determine Internal Revenue Service (IRS) to reduce tax liability and improve their financial performance.

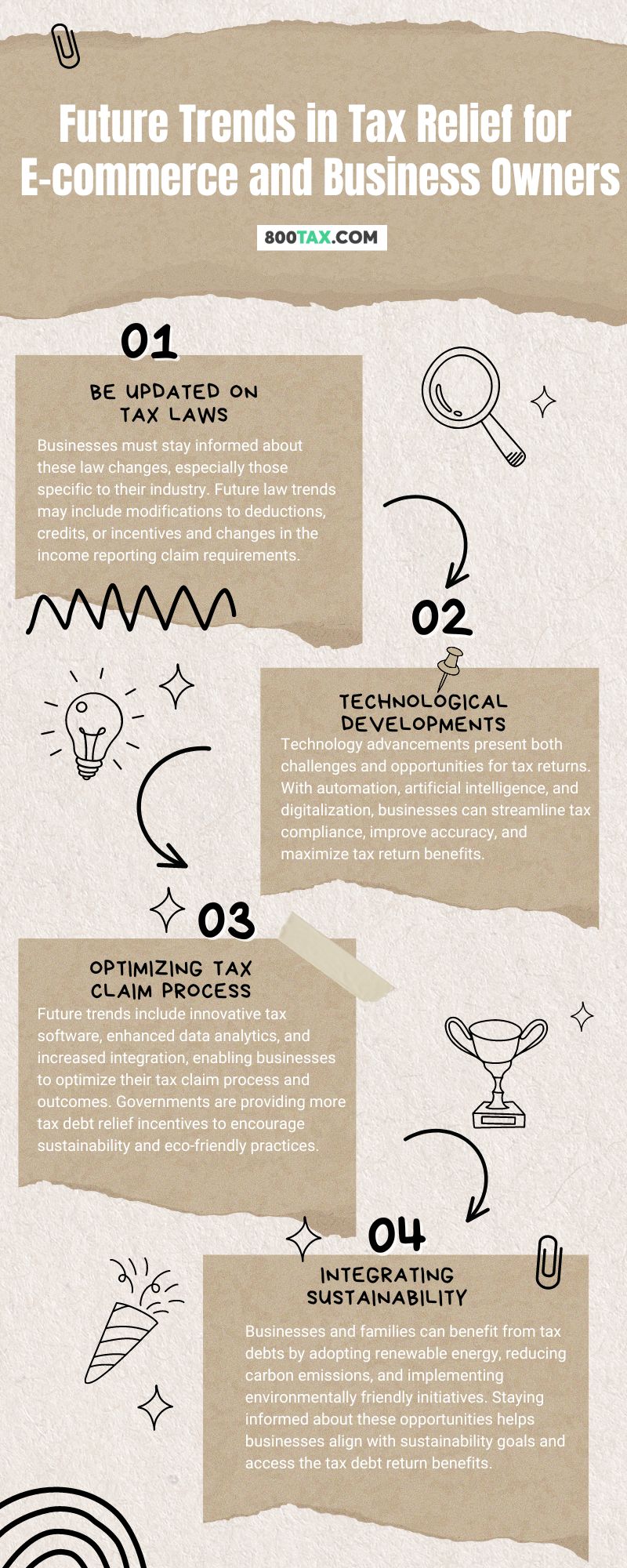

Future Trends in Tax Relief for E-commerce and Business Owners

Staying informed about emerging trends and changes in tax laws is crucial for taxpayers. Federal tax laws are subject to regular updates and revisions.

Businesses must stay informed about these law changes, especially those specific to their industry. Future law trends may include modifications to deductions, credits, or incentives and changes in the income reporting claim requirements.

Technology advancements present both challenges and opportunities for tax returns. With automation, artificial intelligence, and digitalization, businesses can streamline tax compliance, improve accuracy, and maximize tax return benefits.

Future trends include innovative tax software, enhanced data analytics, and increased integration, enabling businesses to optimize their tax claim process and outcomes. Governments are providing more tax debt relief incentives to encourage sustainability and eco-friendly practices.

Businesses and families can benefit from tax debts by adopting renewable energy, reducing carbon emissions, and implementing environmentally friendly initiatives. Staying informed about these opportunities helps businesses align with sustainability goals and access the tax debt return benefits.

Taxpayers’ Tips for Tax Relief Law

To effectively adapt to future trends in tax relief law, taxpayers should:

Stay Informed

- Regularly monitor tax law updates, legislative changes, and industry-specific regulations.

Seek Professional Guidance

- Consult tax professionals to understand the implications of new Internal Revenue Service (IRS) laws and identify tax relief strategies eligible for your business.

Embrace Technology

- Explore software solutions and digital tools to streamline the tax compliance process and maximize available tax refunds.

Maintain Accurate Records

- Accurate record-keeping is crucial for substantiating claims and ensuring compliance with changing reporting requirements.

Plan Strategically

- Develop a proactive tax payments strategy that considers future trends and aligns with your business goals.

Conclusion

Effective tax relief strategies are vital for taxpayers to navigate the complexities of back taxes and maximize back taxes benefits. By implementing these strategies, businesses can reduce and resolve tax problems like liabilities, optimize penalties and credits, and ensure compliance with tax laws set by the Internal Revenue Service (IRS).

We encourage you to take action and explore suitable child tax credits and relief strategies tailored to your company’s needs. Stay informed about child tax credit credits, seek professional assistance from 800TAX, a leading tax advisory firm, and consider subscribing to our newsletter for valuable insights and updates each tax year.

Take advantage of the opportunity to optimize your tax relief efforts, file now and pave the way for retirement and a stronger financial future with the expertise and guidance of 800TAX.