If you are burdened by tax debt, unable to pay your full tax liability, or facing financial hardship, filing for an Offer in Compromise (OIC) could be a viable option.

Are you struggling with tax debt? An Offer in Compromise (OIC) could be the solution for you. It’s a way to settle your debt for less than what you owe, allowing you to start fresh and regain financial stability. Our guide will help you through filing for an OIC, making it easier to understand and follow the necessary steps.

At this stage, you may wonder what an offer in compromise is and how it can benefit you. An offer in compromise enables you to settle your tax debt for less than the full amount you owe, providing you with a fresh start and financial relief.

By gaining deeper insights into the benefits of filing for an offer in the compromise program, you’ll develop a strong desire to explore this option further and see if it aligns with your unique financial situation.

OIC At Glance

Now, if you are intrigued by the idea of filing for an offer in compromise and desiring the relief it can provide, you’re ready to take action!

Throughout this article, we’ll provide a step-by-step guide from determining your eligibility and gathering the necessary documentation to finally submitting your application.

With this knowledge, you’ll be empowered to make informed decisions and take the necessary steps to resolve your tax debt.

So, let’s embark on this journey together as we delve into the world of offer in compromise, its benefits, eligibility criteria, common mistakes to avoid, and the essential steps to follow when applying.

By the end of this article, you’ll have all the tools you need to confidently navigate the process of filing for an offer in compromise and achieve financial peace of mind. Now, let’s dive in and shed light on this valuable process!

What is an Offer in Compromise?

It is an option rendered by the Internal Revenue Service (IRS), allowing taxpayers to pay their tax deficit for less than what they owe. It is based on your unique financial situation and requires a thorough evaluation of your ability to pay, asset equity, expenses, and income.

Generally, the IRS approves an OIC when the offered amount represents the maximum they can expect to collect within a reasonable period. However, exploring other payment options before considering an OIC is essential.

According to a study by Taxpayer Advocate Service, approximately 4-9% of American taxpayers submit multiple OIC within 180 days–which is defined as churning–meaning businesses are trying to have a successful OIC application, even if it results in numerous attempts. Hiring a qualified tax professional to assist you is highly suggested to ensure the best possible outcome.

The Importance of Filing for an Offer in Compromise

Filing for an Offer in Compromise comes with several significant benefits. Firstly, it offers a chance for taxpayers who cannot pay their full tax debt to resolve their financial issues with the Internal Revenue Service.

It can prevent further financial hardship, reduce stress, and allow you to regain control of your financial situation. Additionally, an OIC can save you from the negative consequences of tax debt, such as garnishments and levies, providing a fresh start and a path toward financial freedom.

By offering taxpayers a lower settlement amount, the IRS acknowledges that collecting the full tax debt on real property might be impractical or lead to undue economic hardship for the taxpayer’s assets elsewhere.

Step-by-Step Guide to Filing for an Offer in Compromise

Step 1: Determine Your Eligibility

Before starting the process, you must determine your eligibility for an OIC. Initially, IRS has a pre-qualifier system to determine the applicant’s income eligibility. Ensure you have filed all required tax returns and made all necessary estimated payments for monthly income only.

Additionally, you must not be in an open bankruptcy proceeding and should have a valid extension for a current year’s return if applying for the current year. Before applying, employers must have made tax deposits for the current assets and tax debt included in the current and past 2 quarters required estimated tax payments.

Step 2: Gather the Necessary Documentation

Prepare yourself by gathering all the required documents for filing an Offer in Compromise. This may include financial statements, tax returns, pay stubs, bank statements, and other relevant financial information.

Properly organizing and providing accurate documentation can significantly impact the success of your OIC application. Be transparent and never forge data or any numbers. It will surely impact your integrity as well as the name of the business, so be wise!

Step 3: Submit Your Application

Once you have determined your eligibility and gathered all the necessary documents, it’s time to submit your Offer in Compromise application. The IRS has open access to the forms you will need to complete.

Follow the IRS’s instructions carefully and ensure all required forms are complete and accurate. After submitting your application, be prepared to wait for the IRS to process your offer. Be reminded that as per IRS Form 656 Booklet, OIC applicants will be contacted after the application review.

Once you receive a request for additional information requested documentation about your papers, do your due diligence to promptly respond. If you fail to reply, your application will obviously be affected without appeal rights.

After Application Submission

Once the Internal Revenue Service accepts your offer in compromise, you must timely file all the monthly income tax liability and tax returns and pay all the estimated federal and tax payments that will incur. Failure to do so, and apparently resulting in 5 years due, will default your offer in the compromise program.

If that happens, you will be liable for your original tax liability, diminishing the payments made and the accrued interest and penalties. It’s important to know that making an offer doesn’t stop interest and penalties from accruing.

If you end up paying more than the agreed amount, the IRS won’t give you a refund but instead, apply the excess to your tax debt. Also, if you don’t promptly pay any tax debts assessed after acceptance of your offer for any tax years before acceptance down payment that weren’t included in your original offer, the IRS may default.

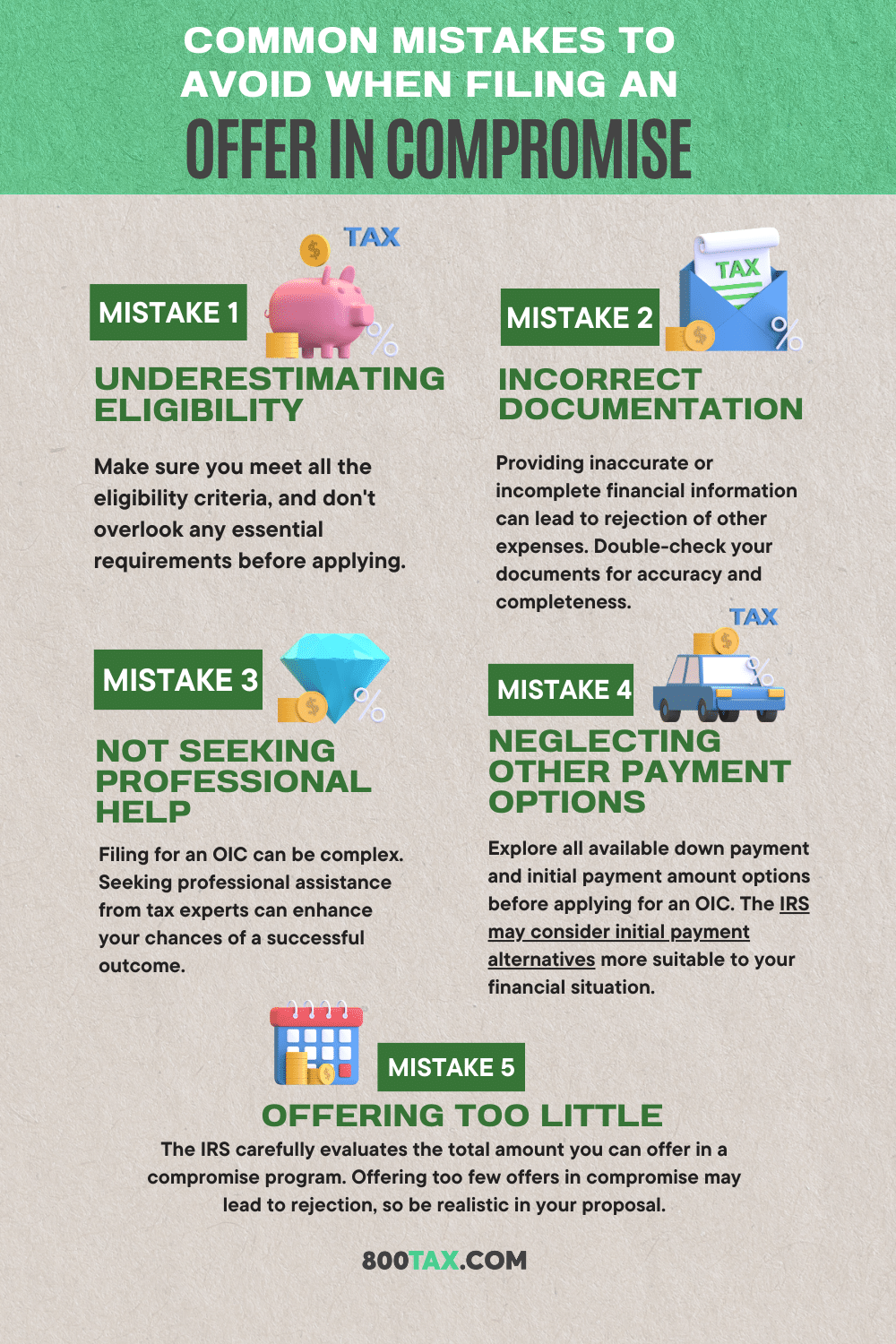

Common Mistakes to Avoid When Filing for an Offer in Compromise

Despite the potential benefits, individuals make common mistakes when filing for an Offer in Compromise. Avoiding these pitfalls can significantly increase your chances of getting your OIC accepted.

- Underestimating Eligibility: Make sure you meet all the eligibility criteria and don’t overlook any essential requirements before applying. If you’re a self-employed individuals and have low-income certification, you’re not required to have any payments for the application fee, lucky you!

- Incorrect Documentation: Providing inaccurate or incomplete financial information can lead to rejection of other expenses. Double-check your documents for accuracy and completeness. Note all the basic living expenses, utilities, monthly installments, necessary living expenses, etc.

- Not Seeking Professional Help: Filing for an OIC can be complex. Seeking professional assistance from tax experts can enhance your chances of a successful outcome. Thousands of tax relief company can assist you in filing your OIC, be sure to check one out.

- Neglecting Other Payment Options: Explore all available down payment and initial payment amount options before applying for an OIC. The IRS may consider initial payment alternatives more suitable to your financial situation. Check out some tax law with supporting documentation about your business. The most common form of payment is the lump sum cash offer, payable in less than 5 installment agreement or months.

- Offering Too Little: The IRS carefully evaluates the total amount you can offer in a compromise program. Offering too few offers in compromise may lead to rejection, so be realistic in your proposal. Check out the IRS website to know what offers in compromise the IRS accepts and what IRS rejects.

Conclusion

Signing up for an Offer in Compromise can be a lifeline for those struggling with tax debt, offering a way to settle for a reduced amount and achieve financial stability.

However, the process requires careful consideration, eligibility evaluation, and accurate documentation. If you cannot pay your tax debt, don’t hesitate to explore the option of an OIC.

Seek professional advice, follow the steps outlined in this guide, and remember that patience and precision can make a significant difference in your OIC application’s success. Make sure to be transparent, and if there’s a problem with your application or exceptional circumstances, don’t overdo it yourself.

Again, consult human services with professional tax knowledge. IRS evaluates and understands the taxpayer’s ability. If want to have installment agreements or fewer installments, let them know. And that’s it! We hope for the success of your OIC application!

FAQs – Frequently Asked Questions

How long does the IRS process an Offer in Compromise take?

The processing time for your application fee for an OIC depends on several factors, such as your case’s complexity and the IRS’s current workload. The IRS may take several months to a year to review and respond to your full application fee amount.

Can I negotiate with the IRS on the settlement amount in an OIC?

Yes, taxpayers can negotiate with the IRS on the settlement amount in your OIC. IRS will determine your own income, financial and tax situation and may accept payment of a lower amount if it represents the most they can expect to manage taxes from you on future income.

What happens if my Offer In Compromise is rejected?

If a tax refund from your OIC is rejected, you can appeal the decision. Alternatively, you may explore other payment options with the IRS to resolve your tax debt.

Can I apply for an OIC on my own, or do I need professional help?

While you can apply for an OIC independently, seeking professional help from qualified tax experts or enrolled agents is highly suggested. They can guide you through the application process, increase your chances of success, and ensure that the collection information statement in your application is accurate and complete.

Will an Offer in Compromise affect my credit score?

Filing for an OIC itself does not directly impact your credit score. However, if you have existing tax liens, resolving your tax debt through an OIC can improve your credit score over time.