Introduction

Facing the dreaded “T-word” (taxes) can stir up more anxiety than an angry swarm of hornets. Whether you’re blindsided by an unexpected bill or slowly drowning in a rising tide of payments past due, the stress of tax debt has the power to transform even the most level-headed person into a frazzled field of nerves.

It’s enough to make your brain feel like an overworked calculator that’s suddenly been asked to balance the national budget – completely overwhelmed! But take heart, dear taxpayer, for help is available to lighten your load. Just as the LifeGuard brand saves nickels and dimes from sinking in the wash, The friendly folks at the IRS have designed Payment Plans to salvage your sense of financial well-being from the choppy waters of debt.

IRS Payment Plans at Glance

Think of these installment agreements as a flotation device that keeps your head above water month after month. No more panicking as penalties and interest charges threaten to drag you under like an insistent undertow. Payment plans offer the stability and structure needed to float your tax troubles downstream at a safer, steadier pace. It’s the light at the end of the tax-time tunnel!

So if the mere thought of tax debt has your stress levels skyrocketing like the Dow during a recession, relax – an IRS Payment Plan could be the calm in the storm. In the pages ahead, we’ll demystify these debt diffusers so you feel empowered to choose one suited to your unique financial forecast. One thing is certain: faced with tax turmoil, there’s no need to just float aimlessly – a payment plan provides a clear course to calmer financial seas ahead!

What are IRS Payment Plans?

IRS Payment Plans, also called installment agreements, are formal arrangements that allow taxpayers to repay their full tax liabilities in smaller, periodic installments over time. They provide a practical solution for individuals and businesses unable to pay the full amount owed to the IRS at once.

Rather than scrambling for a lump-sum payment or dealing with mounting penalties and interest, payment plans streamline the process into scheduled monthly payments. This predictable structure takes the pressure off while still resolving the debt responsibly. It’s a win-win approach that benefits both taxpayers and the IRS.

Benefits of IRS Payment Plans

Here are some of the key advantages of utilizing an IRS Payment Plan:

– Avoid Further Penalties: Payment plans stop additional penalties from accruing on unpaid tax balances when the agreement is in effect. This saves you money in the long run.

– Prevent Enforcement Action: Entering into a payment plan halts aggressive IRS collection efforts like wage garnishment, bank levies, and property seizures.

– Gain Financial Flexibility: Spreading payments out monthly makes tax obligations more affordable to manage alongside other expenses.

– Maintain Payment Terms: As long as you adhere to the plan, the original payment amount and duration stay consistent even if your financial situation changes.

– Remain In Good Standing: Fulfilling your agreement shows the IRS you’re committed to resolving debts, keeping your compliance rating high.

– Seek Modifications If Needed: Circumstances may change, but the IRS can often modify existing payment plans to accommodate temporary hardships.

Key Takeaways

In summary, IRS payment plans offer taxpayers in financial distress a safer way to bring unpaid taxes into compliance over time. The structured process protects you from mounting charges, disruption to your personal finances, and potential damage to your accounts and credit scores. When debt seems overwhelming, a payment agreement provides invaluable breathing room.

Types of IRS Payment Plans

The IRS offers two main types of payment plans to suit various financial situations: Short-Term and Long-Term. Qualifications differ for each option, so understanding the key aspects helps determine the best fit for your needs.

Short-Term Payment Plan

A Short-Term Payment Plan provides a brief repayment period, usually 120 days or less. It serves as a good short-term solution if you expect to pay your entire balance relatively quickly.

Eligibility: To qualify, your unpaid tax balance cannot exceed $50,000, and the IRS must be assured you can pay it off within the agreed timeframe.

Terms: The plan sets fixed monthly payments to retire your debt within 120 days or fewer. Exact amounts are based on your income and expenses.

Benefits: A Short-Term plan helps resolve smaller debts fast without long-term commitment. It prevents issues from escalating if payoff is imminent.

Long-Term Payment Plan

A Long-Term Payment Plan offers extended support, frequently spanning 5 years or more. It acts as a long-haul solution for substantial tax burdens.

Eligibility: There is no debt limit, but you must submit financial records to prove the need for longer repayment terms.

Terms: Agreements last between 5-72 months. Monthly amounts are lower but last much longer to accommodate more significant balances over an extended period.

Benefits: A Long-Term plan gives flexibility to address large debts gradually without overwhelming your finances. It ensures consistent payments keep your account in good standing.

Other Payment Plan Options

The IRS also offers special short-term payment options like the Partial Payment Installment Agreement for those unable to pay a large balance all at once. Additionally, the “Currently Not Collectible” status provides temporary relief if circumstances warrant further delay before payments resume. We’ll explore alternatives more in-depth later.

Applying for an IRS Payment Plan

Now that we understand the available plan types, let’s review the straightforward application process. Taking the proper steps upfront streamlines approval and sets you up for smooth management going forward.

Step 1: Assessing Eligibility

Before applying, ensure you meet basic criteria like filing requirements, payment thresholds, and the ability to pay under the proposed terms. This initial screening saves time if certain options can’t work for your situation.

Step 2: Gathering Required Documents

Have recent tax returns, Form 433 financial statements, and proof of income/expenses ready. The IRS needs this paperwork to verify your situation and ability to make regular installments. Incomplete applications lead to delays.

Step 3: Choosing the Right Plan

Evaluate which payment plan – Short or Long-Term – fits your specific circumstances best. Consider both your total debt amount and projected ability to maintain the proposed monthly payments consistently.

Step 4: Submitting the Application

Complete Form 9465, Installment Agreement Request. Submit your completed application, supporting documentation, and first payment online, by mail, or in person. The IRS aims to respond within 30 days.

Step 5: Receiving IRS Response

If approved, the IRS issues a formal approval notice outlining the agreed payment terms you must follow. Denials typically include reasons for rejection and appeal rights. You may also request adjustments to the proposed plan if desired.

Managing Your Payment Plan

Once your IRS payment agreement is established, consistent management determines the outcome. Proactive communication and financial discipline are paramount for long-term success.

Making Payments On Time

Adhere religiously to the payment schedule. Even one missed or late installment could void your agreement and restart penalties. Set automatic payments or calendar reminders to stay on track effortlessly.

Communicating with the IRS

Promptly inform the IRS if your situation changes significantly, like loss of income or new family expenditures. Short-term relief may be available through plan modifications without disrupting your record.

Monitoring Finances

Watch budgets and cash flow carefully. While on a payment plan, avoid taking on new debt like high-interest credit cards that detract from your ability to meet IRS obligations consistently.

Avoiding New Tax Debts

Stay organized with quarterly tax filings and payments to prevent accumulating more debt that could threaten your compliance or credit standing. On-time payments build goodwill with the IRS.

Seeking Professional Assistance

If facing unforeseen financial hardship or other difficulties maintaining payments, consult a trusted tax professional. Qualified practitioners understand the complexities and can advise strategic next steps.

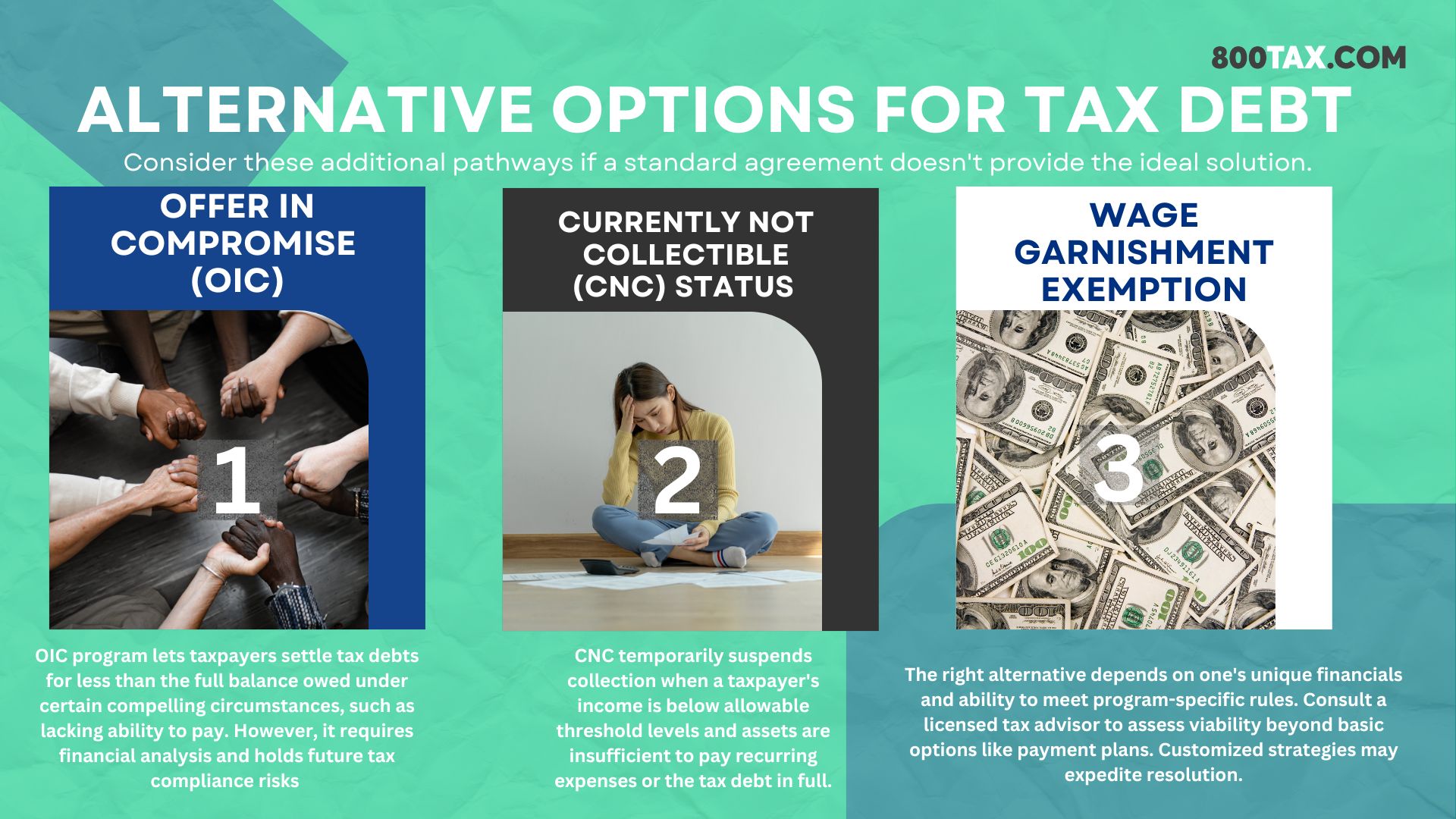

Alternative Options for Tax Debt

While payment plans represent the simplest and most common solution, other alternatives exist depending on individual circumstances. Consider these additional pathways if a standard agreement doesn’t provide the ideal solution.

Offer in Compromise (OIC)

The Offer in Compromise or OIC program lets taxpayers settle tax debts for less than the full balance owed under certain compelling circumstances, such as lacking ability to pay. However, it requires financial analysis and holds future tax compliance risks if terms aren’t satisfied.

Currently Not Collectible (CNC) Status

CNC temporarily suspends collection when a taxpayer’s income is below allowable threshold levels and assets are insufficient to pay recurring expenses or the tax debt in full. No payments are due until their financial picture improves significantly.

Wage Garnishment Exemption

If self-employed or dependent upon full wages for necessary living expenses, you may qualify to shield up to 30% of disposable earnings from IRS garnishment through Form 6368. This buys time to settle liabilities.

The right alternative depends on one’s unique financials and ability to meet program-specific rules. Consult a licensed tax advisor to assess viability beyond basic options like payment plans. Customized strategies may expedite resolution.

Frequently Asked Questions

Now that we’ve covered key details of payment plan mechanics, application, and management, let’s address some common taxpayer questions:

Can I apply for a payment plan online?

Yes, the IRS makes it very convenient to apply for a payment plan electronically through their website at IRS.gov. You can submit Form 9465, Installment Agreement Request, directly online to initiate the application process for more basic payment plans requiring shorter repayment periods and lower total unpaid balances (usually under $50-100k).

The online application portal guides you step-by-step to input the necessary information from your tax returns, income/expense records, and proposed monthly payment amounts directly into the secure web form. You can also upload any supporting documentation files electronically. Within a few weeks, the IRS will review your application and send you their decision via mail. If approved, your online payment plan can start immediately.

Will a payment plan affect my credit?

Having an approved payment plan with the IRS will not normally impact your credit reports or credit scores directly. However, it’s important to note that unpaid federal tax debt itself, if left unaddressed, could potentially be reported to the major credit bureaus as a collection after an extended period of non-payment, delinquency, or non-compliance.

This type of tax collection on credit reports may weigh negatively on creditworthiness and limit your ability to obtain new credit, loans, or financing. Once enrolled in a legitimate payment agreement, consistently making timely installments as scheduled shows an effort to resolve liabilities properly and help shield your credit standing. But if a plan fails or tax debts accumulate excessively over time apart from a plan, credit consequences become more likely. Promptly dealing with obligations can help avoid these secondary effects to FICO Scores and credit histories.